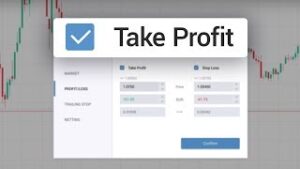

We stated above that the quantity of the take profit order is equal to the initial position. However, there are partial or intermediate take profit orders. These are rather advanced concepts, used by the most experienced traders. If you have just started in your trading activity, it is better to limit yourself to the total take profit order or it is advisable to test your strategy with the demo account made available by Admirals.

Join 4c Trading Signal Telegram Channelmyc signals telegram 4c trading signals 4c trading signals 4c trading signals bot 4c trading review 4c trading bot ai signal 4c trading signal 4c trading signals telegram 4c trading signals twitter 4c trading signals youtube 4c trading tiktok telegram 4c trading signals telegram universal crypto signal universal crypto signals top bitcoin signal providers top bitcoin signal providers crypto coin signals crypto coin signals

For intermediate or partial take profit traders define several take profit levels by identifying several tested levels of resistance and support. Intermediate take profit has two important advantages. First, it allows you to secure part of your earnings. Secondly, the volume of the trade is reduced and, if the prices do not move in the expected direction, the loss is reduced in comparison to the potential loss in the case of a call for a full take profit.

Of course if the prices move in the predicted direction, the gain is also diminished in comparison to the potential profits in the case of full take profit. As we can see, in the case of partial take profit it is rather the security ratio of gain and their maximization.

There are several methods to establish partial take profit levels: the 50/50 method, the triple ladder or the 80/20 method. We will briefly analyze the essence of these strategies.

Join 4c Trading Signal Telegram Channelmyc signals telegram 4c trading signals 4c trading signals 4c trading signals bot 4c trading review 4c trading bot ai signal 4c trading signal 4c trading signals telegram 4c trading signals twitter 4c trading signals youtube 4c trading tiktok telegram 4c trading signals telegram universal crypto signal universal crypto signals top bitcoin signal providers top bitcoin signal providers crypto coin signals crypto coin signals

The 50/50 method

This consists of setting two take profit points to liquidate half of the position with the first take profit and then liquidate the second half with the second take profit. It’s a fairly accurate exit strategy, but it skews the risk-reward ratio because only part of your position will have maximized gains. An important rule is to move the stop loss to the level of the first take profit to cushion losses.

The triple ladder is similar to the 50/50 method except the trader uses 3 take profit points and splits their position into 3 lots. When the first take profit is reached, the first lot is liquidated. The second lot is liquidated when the market price has reached the second take profit point and at the same time the trader moves the stop loss to compensate in case of loss, which makes the trade at this point risk-free. The third lot is liquidated at the upper take profit point. This method allows you to secure gains and follow the market at the same time.

The 80/20 method

This works best in a volatile market or when you are unsure about price movement beyond a certain level. The trader uses two take profit points. The first is set at the most likely level of resistance or support, depending on the long or short position, the second take point and well away from the first, but which the currency market may head towards from time to time.

The trick is to liquidate 80% of the position on the first take profit and wait for market movements to liquidate the remaining 20%. The fact that 80% of the position has been liquidated reassures the trader in case the price does not go in his favor, but, at the same time, if the market reaches the second take profit, the profits are significant following the difference between the entry price and exit price.